Irs Plug-In Electric Drive Motor Vehicle. For use primarily in the u.s. The inflation reduction act’s enactment date (aug.

You may qualify for a credit up to $7,500 for buying a qualified new car or light truck. the credit is available to individuals and businesses. For your own use, not for resale 2.

You May Qualify For A Credit Up To $7,500 For Buying A Qualified New Car Or Light Truck.&Nbsp;The Credit Is Available To Individuals And Businesses.

The treasury department and internal revenue service (irs) released new guidelines on friday outlining how consumers can access federal tax credits for electric.

For Use Primarily In The U.s.

Phevs are powered by an internal combustion engine and an electric motor that uses energy stored in a battery.

For Vehicles Acquired For Personal Use, Report The Credit From Form 8936 On The Appropriate.

Images References :

Source: www.templateroller.com

Source: www.templateroller.com

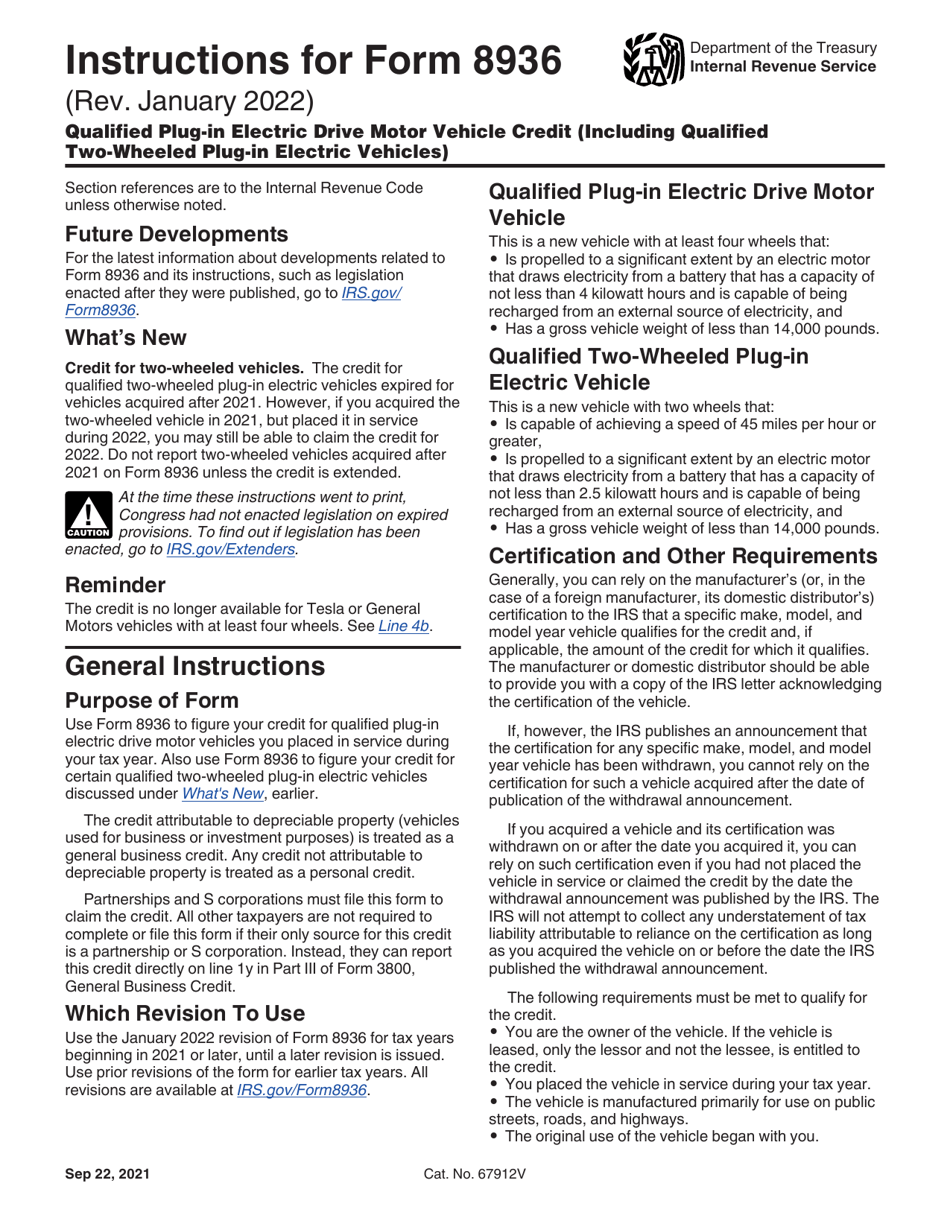

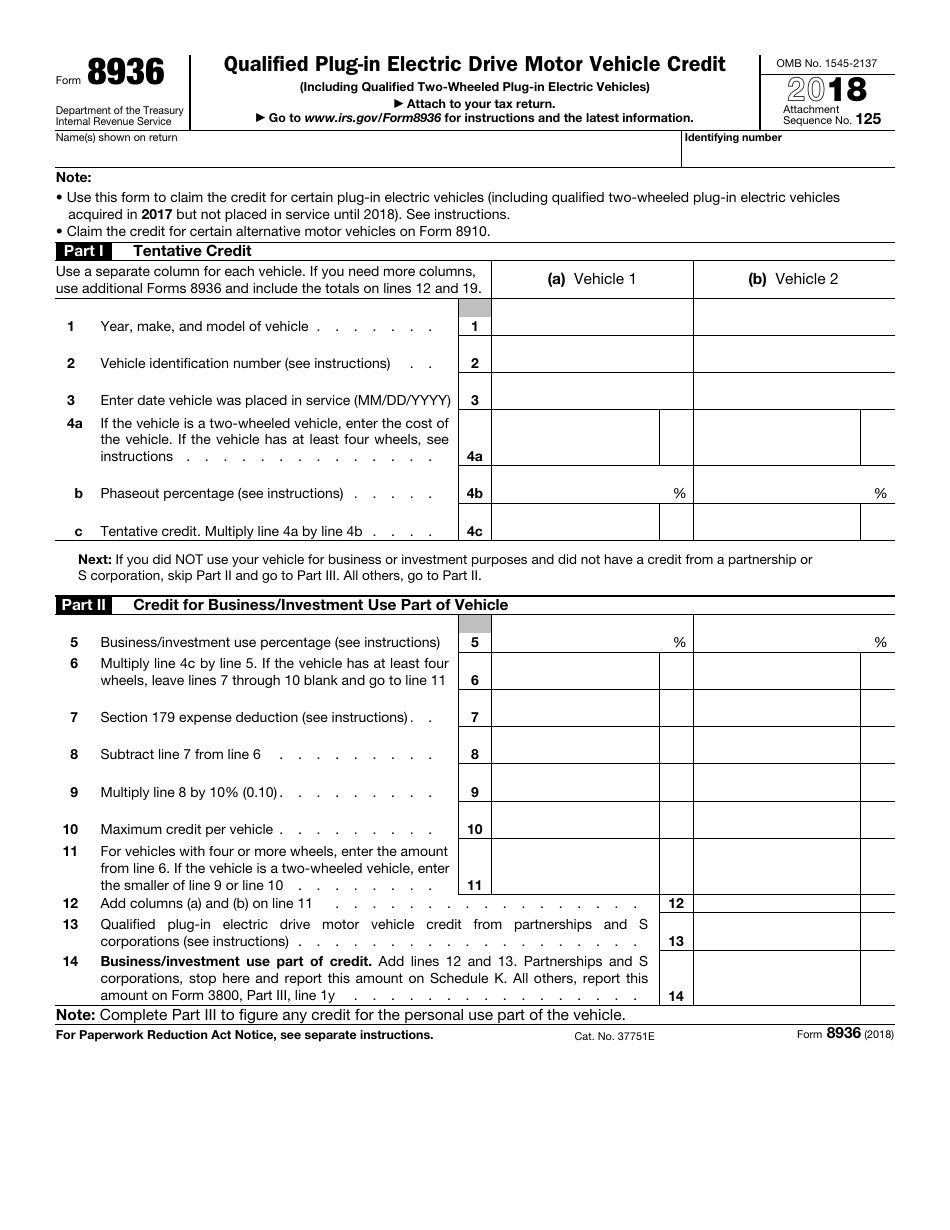

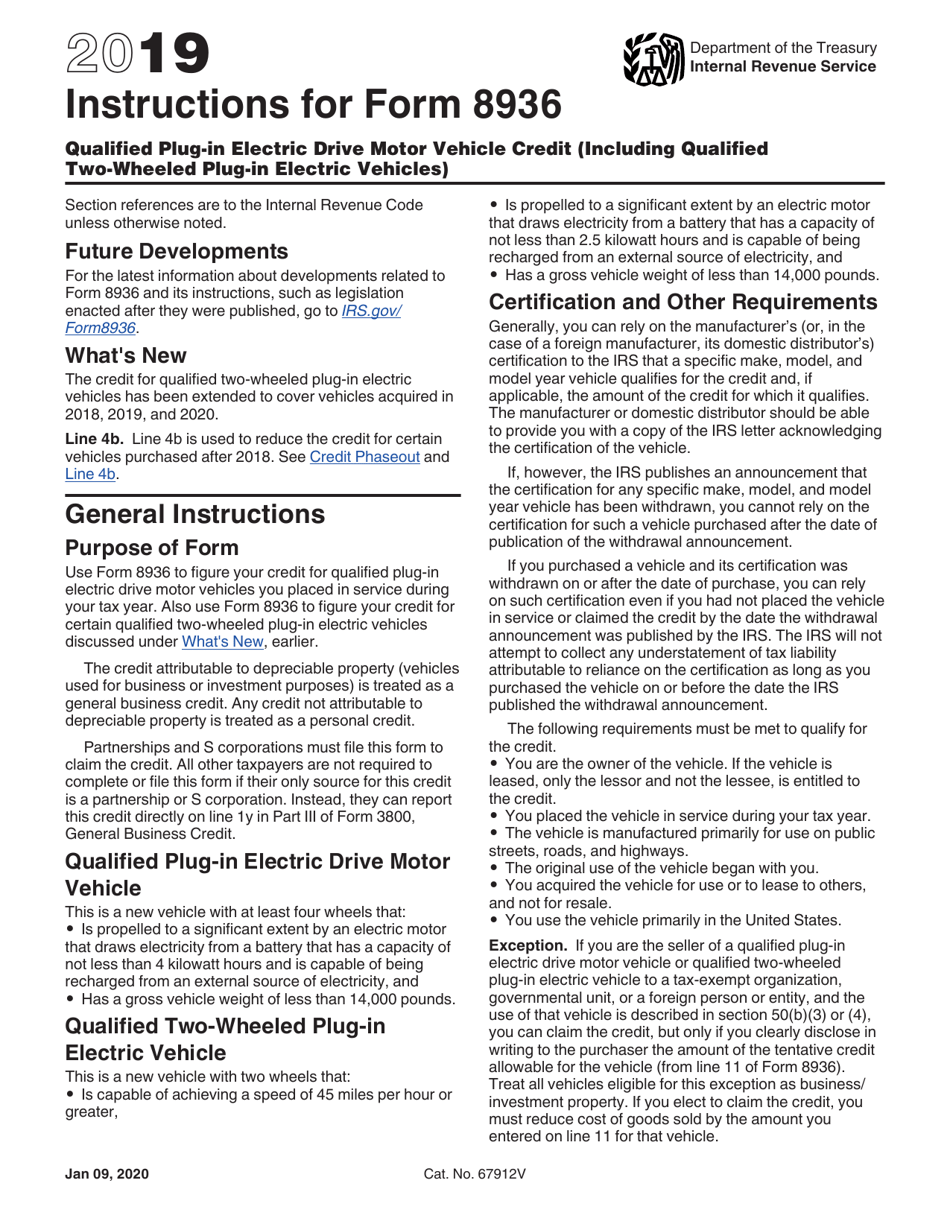

Download Instructions for IRS Form 8936 Qualified PlugIn Electric, To qualify, you must buy the vehicle: For your own use, not for resale 2.

Source: www.pinterest.com

Source: www.pinterest.com

PlugIn Electric Drive Vehicle Credit (IRC 30D) Electricity, Plugs, Phevs are powered by an internal combustion engine and an electric motor that uses energy stored in a battery. Information regarding vehicle models that are newly qualified for section 30d credits by the irs.

Source: windes.com

Source: windes.com

IRS Adds Hyundai PlugIn Electric Vehicles to Credit List Windes, The inflation reduction act’s enactment date (aug. To qualify, you must buy the vehicle:

Source: www.templateroller.com

Source: www.templateroller.com

Download Instructions for IRS Form 8936 Qualified PlugIn Electric, To qualify, you must buy the vehicle: The inflation reduction act’s enactment date (aug.

Source: www.templateroller.com

Source: www.templateroller.com

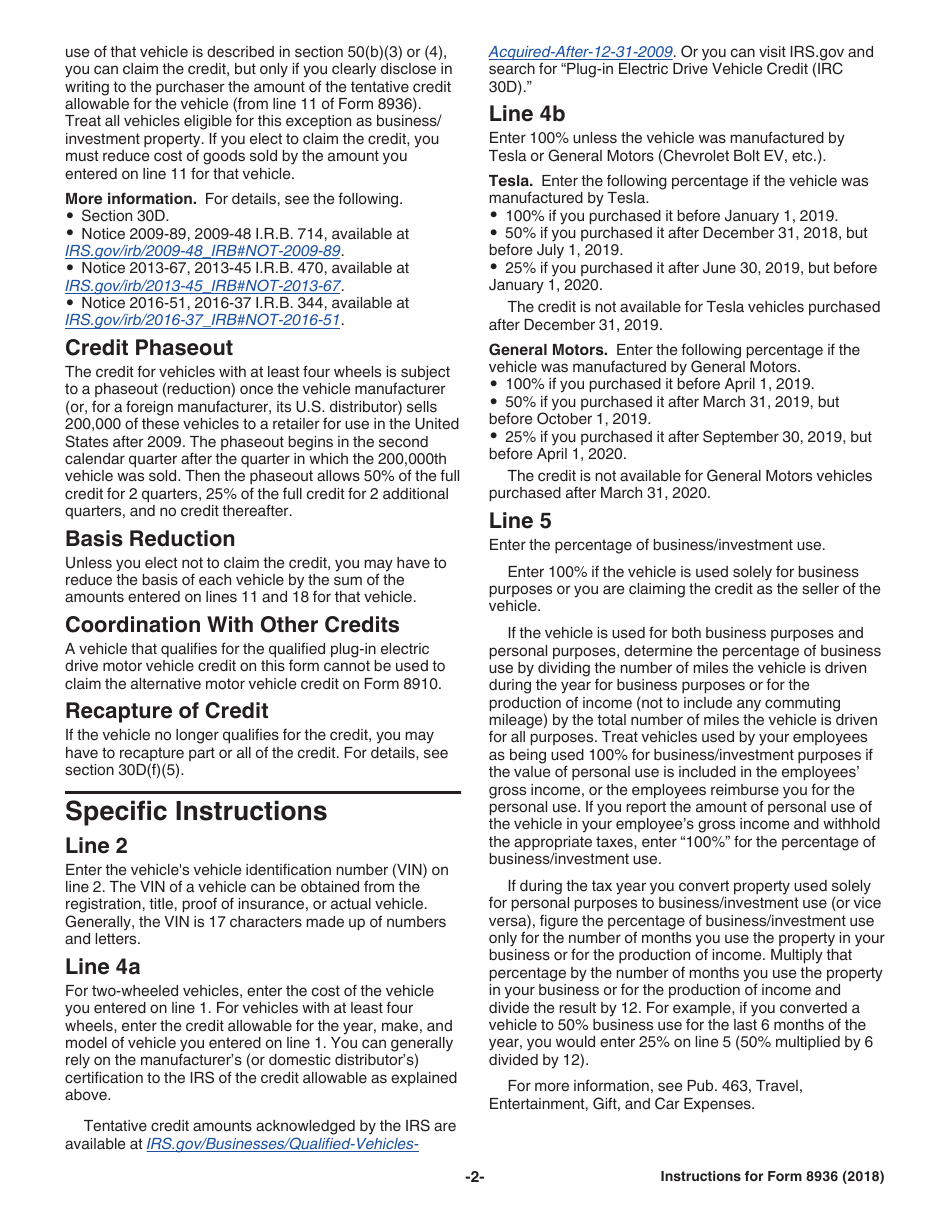

IRS Form 8936 2018 Fill Out, Sign Online and Download Fillable PDF, For use primarily in the u.s. For your own use, not for resale 2.

Source: creditwalls.blogspot.com

Source: creditwalls.blogspot.com

Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit, An electric vehicle eligible for a credit if placed in service prior to jan. To qualify, you must buy the vehicle:

Source: www.formsbirds.com

Source: www.formsbirds.com

Form 8936 Qualified Plugin Electric Drive Motor Vehicle Credit (2014, The inflation reduction act’s enactment date (aug. For vehicles acquired for personal use, report the credit from form 8936 on the appropriate.

Source: taxes52.com

Source: taxes52.com

IRS Adds Audi, MINI, and Toyota Prius Models to Plugin Electric, You may qualify for a credit up to $7,500 for buying a qualified new car or light truck.the credit is available to individuals and businesses. For use primarily in the u.s.

Source: www.templateroller.com

Source: www.templateroller.com

Download Instructions for IRS Form 8936 Qualified PlugIn Electric, You may qualify for a credit up to $7,500 for buying a qualified new car or light truck.the credit is available to individuals and businesses. For vehicles acquired for personal use, report the credit from form 8936 on the appropriate.

Source: www.templateroller.com

Source: www.templateroller.com

Download Instructions for IRS Form 8936 Qualified PlugIn Electric, Information regarding vehicle models that are newly qualified for section 30d credits by the irs. For your own use, not for resale 2.

Authored By Rsm Us Llp.

An electric vehicle eligible for a credit if placed in service prior to jan.

The Inflation Reduction Act’s Enactment Date (Aug.

The treasury department and internal revenue service (irs) released new guidelines on friday outlining how consumers can access federal tax credits for electric.